What Is a 1031 Exchange and How Does It Work in Orange County?

Selling a commercial property in Orange County often creates a unique tension for experienced owners. Long-term appreciation and limited supply have pushed values higher, but those gains also bring meaningful tax exposure at the point of sale. For seasoned Orange County CRE investors, however, the real risk is not the tax itself. It is making a rushed reinvestment decision under artificial deadlines without fully understanding how that move affects the portfolio as a whole.

This is where a 1031 exchange becomes a critical planning tool rather than a transactional afterthought. While widely referenced, it is often oversimplified or treated as a checkbox instead of a strategic decision. In a market defined by high pricing, competition, and compressed timelines, understanding how a 1031 exchange truly works and how it fits into broader portfolio strategy is essential before a property ever goes to market.

What a 1031 Exchange Is in Simple Terms

A 1031 exchange is a tax-deferral strategy defined under Section 1031 of the U.S. Internal Revenue Code. It allows an owner to sell real property held for investment or business use and reinvest the proceeds into another qualifying property without immediately paying capital gains taxes or depreciation recapture.

The key concept is deferral, not forgiveness. The tax liability is carried forward into the replacement property. Over time, many investors continue exchanging properties, rolling gains forward while repositioning capital, improving asset quality, or adjusting risk exposure.

In Orange County, 1031 exchanges are commonly used when:

A long-held asset carries significant embedded gains

Impending loan maturities create refinancing risk or reduced flexibility

Management intensity no longer aligns with ownership or lifestyle goals

The portfolio needs rebalancing by asset type, geography, or risk profile

At its core, a 1031 exchange is about preserving capital so more equity remains invested and productive rather than diverted to taxes at the point of sale.

Which Properties Qualify Under IRS Rules

Both the relinquished property and the replacement property must meet specific requirements set by the Internal Revenue Service.

The property being sold must be held for investment or for productive use in a trade or business. Primary residences, second homes used primarily for personal enjoyment, and properties held primarily for immediate resale do not qualify. While the IRS does not define a specific minimum holding period, the intent to hold the property for investment is critical and should be supported by facts and documentation.

Replacement properties must also be real property held for investment or business use. For real estate, the definition of “like-kind” is broad and does not require the replacement property to be the same asset type.

Common Orange County exchange scenarios include:

Retail exchanged into industrial or flex

Office exchanged into multi-tenant retail

A single property exchanged into multiple assets

Local properties exchanged into out-of-county or out-of-state investments

What ultimately matters is intent. Both the relinquished and replacement properties must be acquired and held with the purpose of investment, not short-term resale or personal use.

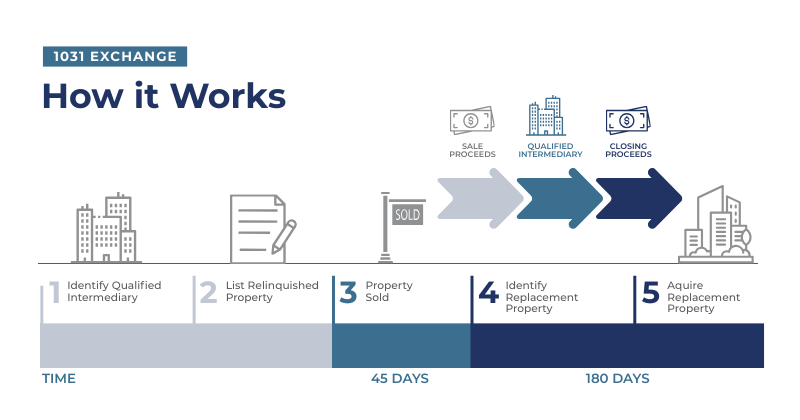

Key 1031 Timelines Explained Clearly

The timelines in a 1031 exchange are strict and unforgiving. Missing them almost always results in a failed exchange and immediate tax recognition. For this reason, successful exchanges typically begin well before a property is listed, with replacement options evaluated in parallel with pricing and timing decisions rather than after escrow has already opened.

The 45-Day Identification Period

Within 45 calendar days of closing the sale of the relinquished property, the exchanger must formally identify potential replacement properties in writing.

Identification must follow one of these IRS-approved rules:

Three-Property Rule: Identify up to three properties, regardless of value

200% Rule: Identify more than three properties as long as their combined value does not exceed 200% of the relinquished property’s value

95% Rule: Identify any number of properties, provided at least 95% of the identified value is ultimately acquired

Most Orange County investors rely on the three-property rule due to pricing, competition, and limited availability of suitable replacement assets.

The 180-Day Exchange Period

The replacement property purchase must be completed by the earlier of:

180 calendar days from the sale of the relinquished property

The due date of the taxpayer’s return for the year of sale, including extensions

This nuance is critical and often overlooked. In year-end transactions, filing a tax return extension is frequently necessary to preserve the full exchange window and avoid an unintended tax event.

How Orange County Market Conditions Affect Exchange Strategy

Orange County presents unique challenges for 1031 exchanges due to pricing, competition, and limited inventory at institutional-quality levels.

Recent significant Orange County retail and commercial sales commonly fall in the high single-digit millions through $30 million-plus, depending on tenant quality, location, and asset size. These price points can restrict replacement options, particularly for owners seeking similar income without adding capital.

Local conditions that often shape exchange strategy include:

Higher price-per-square-foot compared to secondary markets

Lower cap rates in core submarkets

Competitive bidding environments for well-located assets

Escrows that require decisive underwriting and clean execution

Because of this, many Orange County investors expand their exchange search beyond county lines, pairing local expertise with regional or national diversification to balance yield, risk, and timing.

Common Mistakes OC Investors Make During Exchanges

In our experience, most exchange problems are not technical failures. They are planning failures that surface once the clock starts. The IRS rules are clear. The challenge in Orange County is strategic execution under compressed timelines.

One of the most common mistakes is treating the exchange as an afterthought rather than a planning exercise. In a high-cost, competitive market, replacement properties often need to be identified, underwritten, and aligned with financing well before the sale closes to avoid rushed reinvestment decisions.

Other frequent errors include:

Overestimating replacement income in today’s pricing environment, where maintaining the same cash flow often requires accepting higher leverage, a different asset type, or geographic diversification

Assuming financing timelines will naturally align with exchange deadlines

Identifying unrealistic properties simply to satisfy the 45-day identification requirement

Failing to coordinate brokers, lenders, CPAs, and qualified intermediaries early in the process

In high-cost markets like Orange County, time pressure magnifies every weak assumption. Exchange planning must begin before a property is marketed, not after escrow opens. This is also why many successful exchanges are best understood through real-world case studies, where the challenge, strategy, and outcome reveal what actually works when timelines and market conditions collide.

When a 1031 Exchange Makes Sense and When It Does Not

A 1031 exchange is not always the optimal strategy.

It often makes sense when tax deferral materially increases reinvestment power, and the replacement asset enhances long-term positioning, whether through reduced management costs, improved tenant quality, or better alignment with portfolio goals.

It may not make sense when:

The owner plans to fully exit real estate

Replacement options introduce disproportionate risk

Debt replacement materially worsens cash flow

Estate or succession planning favors alternative structures

In some cases, paying the tax and redeploying capital with full flexibility may be the more strategic decision. The value of a 1031 exchange should always be evaluated at the portfolio level, not in isolation.

How Advisors Model Exchanges at the Portfolio Level

Experienced advisors do not view 1031 exchanges as standalone transactions. They evaluate them within the context of the entire portfolio, focusing on how each decision affects risk, income, and long-term flexibility rather than just tax deferral.

This modeling typically includes:

Asset-level performance, downside risk, and capital requirements

Loan maturities and refinancing exposure across the portfolio

Tenant concentration and lease rollover timing

Capital gains and depreciation recapture exposure

Market-cycle positioning by asset class and geography

By evaluating these factors together, owners can determine whether selling, holding, refinancing, or exchanging best supports their long-term objectives. In many cases, sequencing decisions over multiple years creates better outcomes than forcing a single transaction to accomplish every goal at once.

For example, one portfolio-level exchange involved the sale of a Southern California industrial property with existing deferred maintenance and limited income growth. Rather than reinvesting locally, the seller exchanged into a corporate auto center retail property in the Chicago area. The result was a newer asset in a stronger demographic market, no deferred maintenance exposure, and an increase in annual net cash flow of approximately 20%. This type of outcome is rarely visible when exchanges are evaluated property by property instead of through a broader portfolio lens.

Closing Thoughts and Next Steps

A 1031 exchange remains one of the most powerful tools available to Orange County commercial real estate owners, but only when executed with clarity, planning, and realistic expectations. In a market defined by high values and limited margin for error, successful exchanges are rarely reactive. They are intentional, well-timed, and aligned with a broader portfolio strategy.

At The Resha Group, we work with owners before a property goes to market, helping evaluate timing, tax exposure, replacement feasibility, and market conditions so exchange decisions are intentional rather than reactive. If you are considering selling a commercial property in Orange County and want to understand whether a 1031 exchange fits into your overall investment plan, we invite you to schedule a confidential portfolio or property review and gain clarity on your next strategic move.