What Deferred CapEx Really Costs Commercial Property Owners Over Time

Deferred capital expenditures, often called deferred CapEx, may seem like a simple bookkeeping choice in the moment. A landlord delays a roof replacement, postpones HVAC upgrades, or pushes parking lot resurfacing into the following year to preserve cash. In uncertain markets or tighter lending environments, that decision can feel practical.

Deferred CapEx, however, is rarely neutral.

Over time, delayed capital investments can shift risk, increase variability in expenses, influence tenant negotiations, and affect how buyers and lenders evaluate the property. In high-value markets such as Orange County, where underwriting sensitivity to condition and durability can materially affect pricing, capital timing becomes strategic.

This guide explains what deferred CapEx includes, how delays compound, how property condition influences valuation, and why capital planning should align with refinance and exit strategy.

What Deferred CapEx Actually Includes

In commercial real estate, capital expenditures refer to investments that extend a property’s useful life or maintain its long-term functionality. These differ from operating expenses because they preserve structural integrity or materially improve the asset.

Common examples include:

• Roof replacement

• HVAC or major mechanical system upgrades

• Parking lot resurfacing

• Elevator modernization

• Façade improvements and common area renovations

• Code-related or accessibility upgrades

When major systems operate beyond their intended lifecycle without replacement, the probability of failure increases. Owners often continue repairing aging systems rather than replacing them, preserving short-term cash flow.

Deferred CapEx occurs when those investments are postponed beyond their optimal window.

At that point, the issue is no longer simply cost. It becomes risk.

How Small Delays Compound Over Time

When CapEx is deferred, the expense does not disappear. It shifts in timing and often in character.

Two consistent patterns tend to emerge.

1. Predictability Becomes Variability

Planned replacements are budgeted and scheduled. Deferred systems operate until failure occurs. When that happens, repairs are reactive rather than strategic.

A roof operating beyond its lifecycle may leak unexpectedly. Mechanical systems that are repeatedly repaired rather than replaced can experience unpredictable downtime. Reactive repairs can disrupt tenants and compress operational stability.

2. Competitive Positioning Gradually Weakens

Tenants evaluate buildings relative to alternatives. Visible wear, inconsistent systems, and aging infrastructure influence perception.

Even when occupancy remains stable, renewal negotiations may shift. Rent growth may slow. Concessions may increase. Lease terms may shorten.

Properties rarely decline abruptly. Negotiating leverage shifts gradually.

Case Study: When Repair Cost Becomes Risk Cost

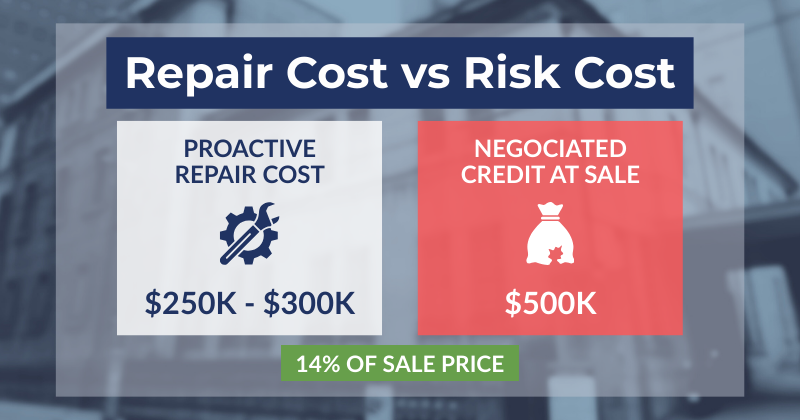

Last year, we sold a property for $3,500,000 where deferred capital became a central issue during due diligence.

The buyer identified:

• A roof nearing end of life

• Multiple HVAC units inoperable upon inspection

• Exterior condition and general appearance suggesting broader deferred maintenance and cleanup concerns

The seller ultimately credited the buyer $500,000 at closing.

Based on contractor estimates, the roof and HVAC work likely would have cost approximately $250,000–$300,000 if completed proactively before bringing the property to market.

However, once identified during due diligence, the issue shifted from repair cost to risk cost.

It became about:

• Perceived uncertainty

• Potential additional latent issues

• Negotiation leverage shifting to the buyer

• Lender scrutiny and reserve concerns

That dynamic expanded the negotiated credit to $500,000, roughly 14 percent of the sale price.

The takeaway is not that repairs are inherently expensive. It is that deferred capital often doubles in impact once uncertainty enters underwriting and negotiation.

This is where strategic advisory work matters. The question becomes not simply whether to repair, but when and how those repairs align with exit or refinance timing.

Effect on Valuation and Exit Pricing

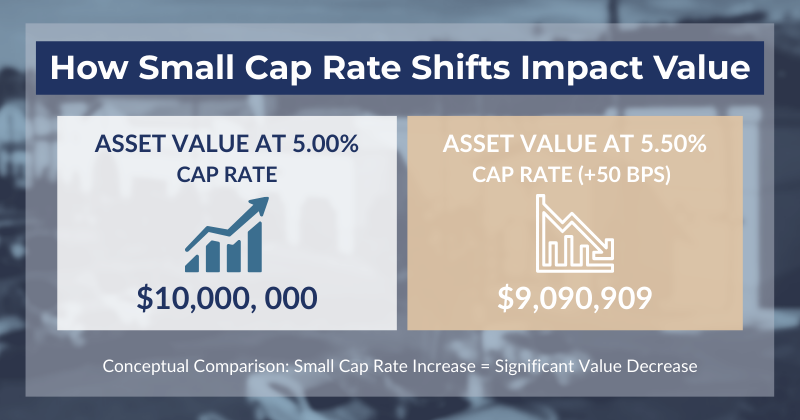

Valuation in commercial real estate is influenced by income durability and perceived risk.

Deferred CapEx can affect valuation in two primary ways.

First, if property condition influences tenant stability or rent growth, net operating income may grow more slowly.

Second, buyers incorporate anticipated capital expenditures into underwriting. They evaluate not only the repair cost but the uncertainty surrounding execution.

Even modest cap rate sensitivity can materially influence value. In multi-million-dollar assets, a 25–50 basis point shift in cap rate driven by perceived physical risk can translate into significant pricing differences. Condition influences risk perception, and risk perception influences valuation.

Institutional capital sources and many lenders require property condition assessments during due diligence. Identified capital requirements may affect reserves, loan structure, and leverage.

Why Buyers and Lenders Evaluate Deferred Maintenance Carefully

Deferred maintenance introduces underwriting uncertainty.

A property requiring immediate capital investment changes negotiation dynamics. Buyers may seek pricing adjustments or reserves. Lenders may apply additional scrutiny.

Physical risk becomes part of credit risk.

Deferred CapEx does not simply transfer cost to the next owner. It influences leverage, timing, and optionality.

Common CapEx Blind Spots in Orange County Assets

In markets with long-held ownership patterns and aging assets, certain blind spots appear frequently.

Vintage Retail Centers

Façade upgrades, parking lot resurfacing, and mechanical replacements are often deferred because they do not immediately increase rent. Over time, competitiveness relative to renovated centers can decline.Suburban Office Buildings

Without updated common areas or mechanical reliability, negotiation leverage may shift toward tenants.Industrial Flex Properties

Aging roof systems, dock equipment, and electrical infrastructure can influence lease flexibility and renewal dynamics.Mixed-Use Assets

Deferred structural or common area work can affect multiple revenue streams simultaneously.

Across asset types, parking lot work, elevator modernization, HVAC replacement, and code compliance improvements are frequently postponed. Over time, these influence underwriting perception.

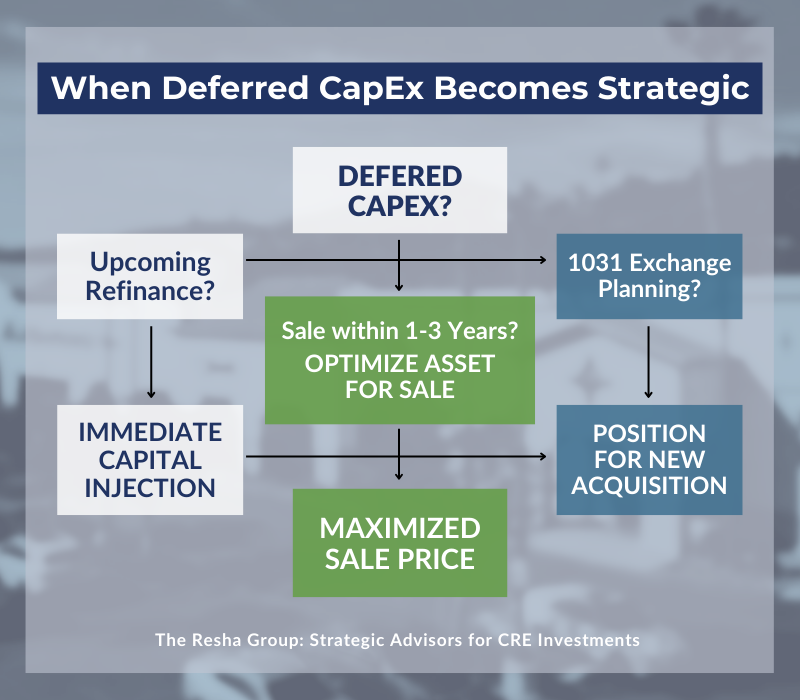

When Deferred CapEx Becomes a Strategic Decision

Capital timing should align with broader portfolio objectives.

Deferred CapEx becomes strategic when tied to:

Upcoming Refinance

Lenders evaluating property condition may incorporate capital needs into underwriting assumptions. Completing critical improvements before refinancing can influence leverage and structure.Sale Within 1–3 Years

If disposition is planned, addressing major capital items before marketing can reduce due diligence volatility and strengthen negotiating position.1031 Exchange Planning

Capital improvements may influence pricing strength, identification flexibility, and reinvestment capacity

Capital timing should not be evaluated in isolation. It should be coordinated with refinance, sale, and exchange strategy.

This is where advisory positioning differs from transactional thinking. The question is not simply what needs repair, but how timing affects outcomes.

How Proactive Planning Protects Long-Term Equity

Proactive CapEx planning integrates lifecycle forecasting into portfolio strategy.

Structured planning supports:

• More predictable cash flow

• Stronger tenant retention

• Improved negotiation positioning

• Greater financing flexibility

• Clearer exit optionality

Forecasting system lifecycles and aligning them with capital events reduces the likelihood of liquidity strain at critical moments.

Over extended ownership periods, properties managed with coordinated capital planning often demonstrate smoother performance profiles than those managed reactively.

Conclusion

Deferred CapEx is not merely a short-term budgeting decision. It is a strategic choice that can influence income stability, valuation, financing structure, and exit leverage.

While postponing capital expenditures may preserve cash in the near term, extended deferral can introduce variability and reduce flexibility at critical moments such as refinance, sale, or exchange.

For Orange County owners evaluating upcoming capital decisions, reviewing system lifecycles alongside refinance or exit timing can materially affect outcomes. A structured capital review often reveals whether to accelerate, phase, or strategically defer improvements in alignment with broader portfolio objectives.

If you own retail, industrial, office, or mixed-use property in Orange County or coastal Southern California and are weighing upcoming capital projects against refinance or disposition plans, The Resha Group can help you evaluate the trade-offs. We work with owners to model timing scenarios, assess buyer and lender sensitivity to condition, and determine how capital decisions affect negotiating leverage and long-term positioning.

To request a confidential capital and portfolio review, contact The Resha Group or submit your property information through our website to begin a strategic evaluation.